Category

Category

Residential & Investment Finance

Residential & Investment Finance

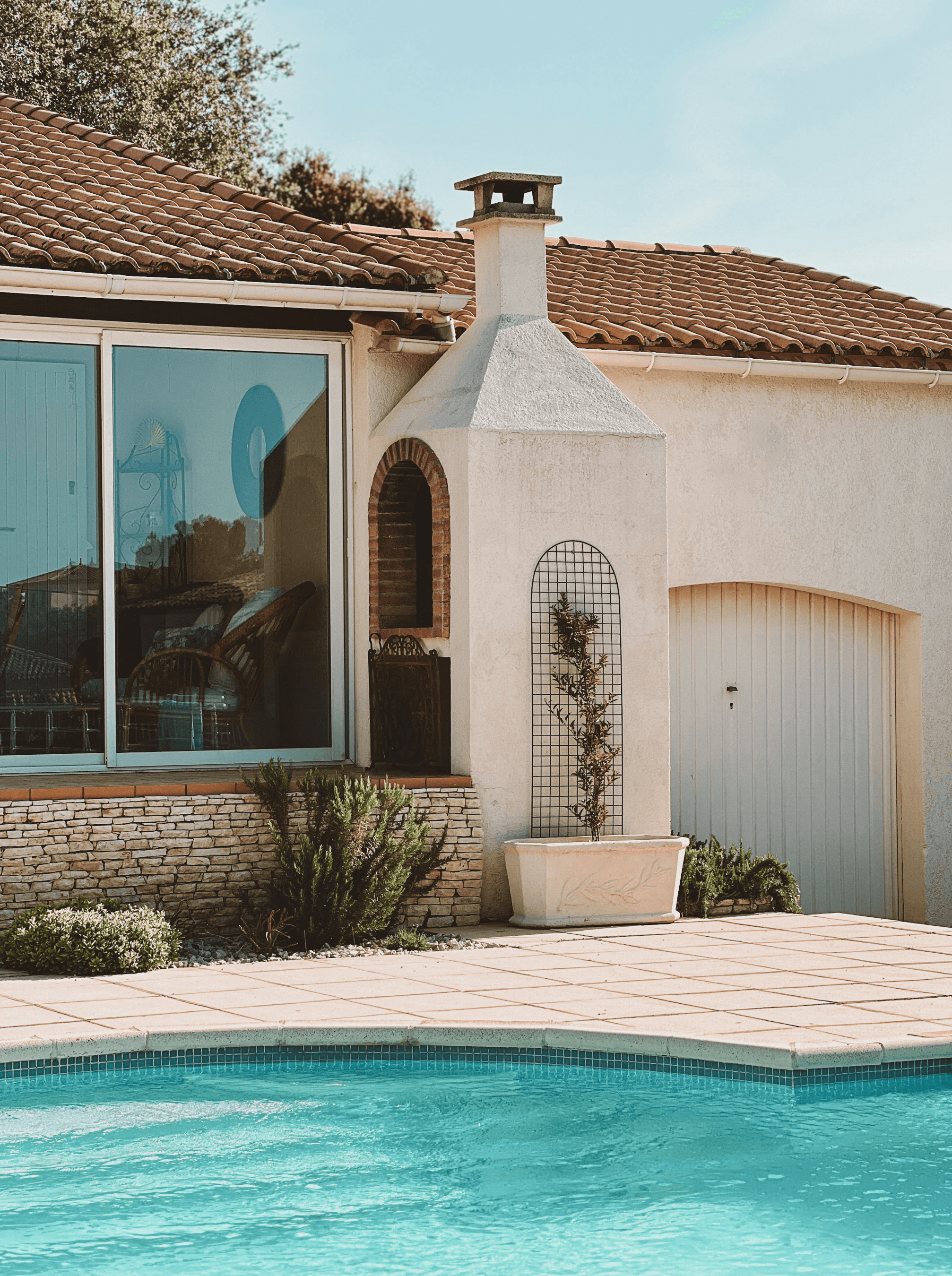

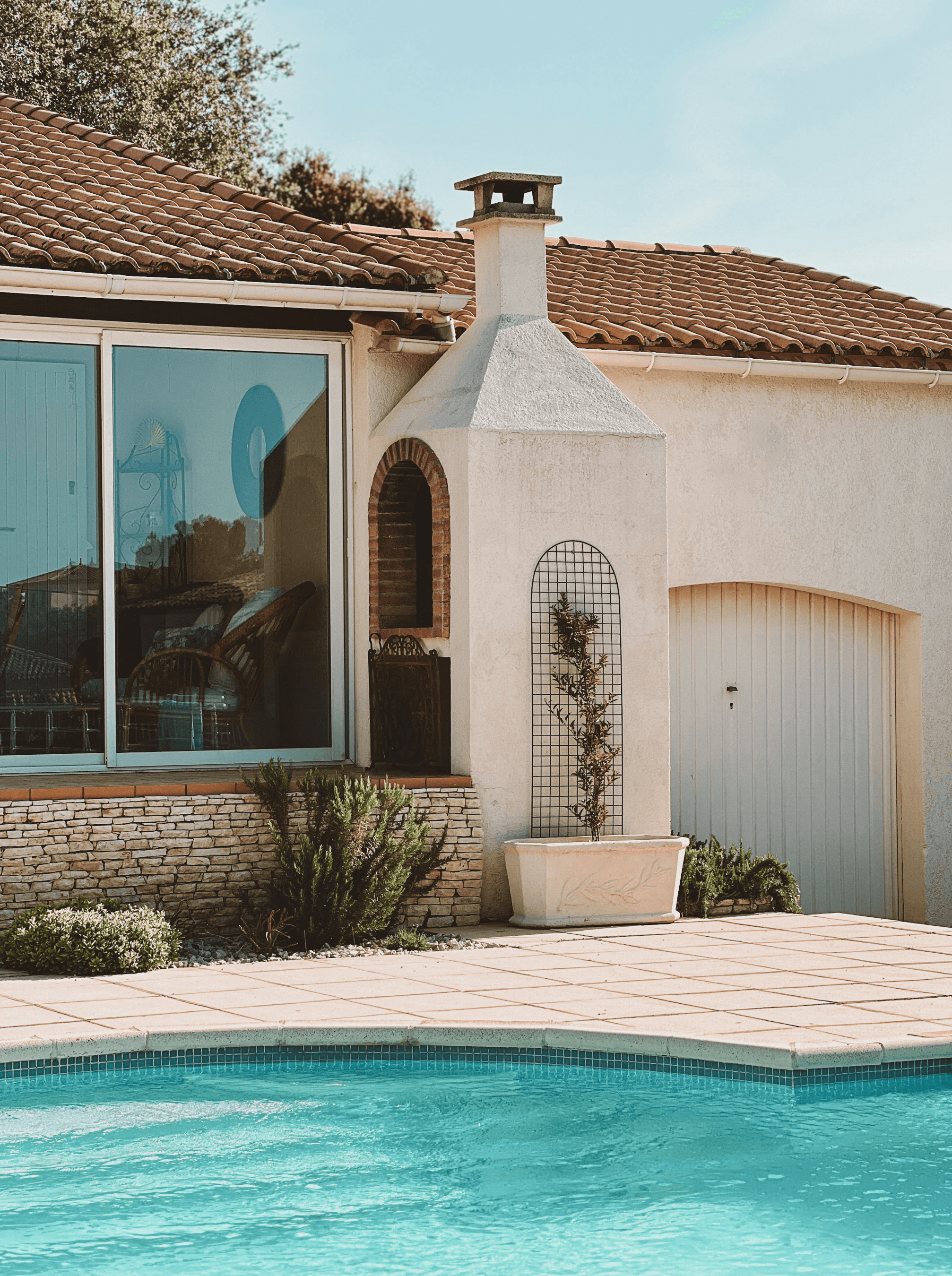

Helping homeowners and investors secure the right loan structure with clarity, speed, and long-term confidence.

Helping homeowners and investors secure the right loan structure with clarity, speed, and long-term confidence.

Clear lending decisions start with the right structure

Buying or investing in property is not just about getting approved. It is about choosing the right loan structure from the beginning. We work closely with you to understand your position today, where you are heading, and how your lending should support that journey.

Most borrowers are offered products, not strategies. Our role is to slow the process down, ask the right questions, and design finance that actually fits your life and plans. This approach creates confidence, flexibility, and fewer surprises over time.

We assist first-home buyers, upgraders, downsizers, and experienced investors across Australia. Every recommendation is based on your income, assets, risk appetite, and future plans, not generic lending rules.

Investment lending is approached with structure in mind, including cash flow, tax considerations, and portfolio growth. Whether you are purchasing your first investment property or expanding an existing portfolio, the goal is sustainability and clarity.

You will always know why a recommendation is made, how it works, and what it means for you long term. No pressure, no confusion, just informed decisions.

Clear lending decisions start with the right structure

Buying or investing in property is not just about getting approved. It is about choosing the right loan structure from the beginning. We work closely with you to understand your position today, where you are heading, and how your lending should support that journey.

Most borrowers are offered products, not strategies. Our role is to slow the process down, ask the right questions, and design finance that actually fits your life and plans. This approach creates confidence, flexibility, and fewer surprises over time.

We assist first-home buyers, upgraders, downsizers, and experienced investors across Australia. Every recommendation is based on your income, assets, risk appetite, and future plans, not generic lending rules.

Investment lending is approached with structure in mind, including cash flow, tax considerations, and portfolio growth. Whether you are purchasing your first investment property or expanding an existing portfolio, the goal is sustainability and clarity.

You will always know why a recommendation is made, how it works, and what it means for you long term. No pressure, no confusion, just informed decisions.

Contact

Contact

Contact

You’re in the right place to start!

If you’re considering your next move, we’re here to help you think it through properly.

FAQ

FAQ

FAQ

You’re in the right place if you’re wondering…

How do I know if I’m in the right place for my situation?

What happens in the first conversation?

Do I need to have everything prepared before reaching out?

Is there any obligation to proceed after an initial discussion?

How do you approach more complex or non-standard scenarios?

Do you work with a wide range of lenders or specific partners only?

How long does the process usually take?

What makes your approach different from larger broker groups?

How do I know if I’m in the right place for my situation?

What happens in the first conversation?

Do I need to have everything prepared before reaching out?

Is there any obligation to proceed after an initial discussion?

How do you approach more complex or non-standard scenarios?

Do you work with a wide range of lenders or specific partners only?

How long does the process usually take?

What makes your approach different from larger broker groups?

How do I know if I’m in the right place for my situation?

What happens in the first conversation?

Do I need to have everything prepared before reaching out?

Is there any obligation to proceed after an initial discussion?

How do you approach more complex or non-standard scenarios?

Do you work with a wide range of lenders or specific partners only?

How long does the process usually take?

What makes your approach different from larger broker groups?

Our services

You may also be in the right place for..

Our services are built to support different stages, goals, and levels of complexity.

Our services

We offer a range of strategic services

Comprehensive suite of services designed to help organizations navigate complex advocacy landscapes and achieve their goals.

Our services

We offer a range of strategic services

Comprehensive suite of services designed to help organizations navigate complex advocacy landscapes and achieve their goals.

You’re in the right place to take the next step

If you’re ready to talk through your options or simply want clarity, we’re here to help.

You’re in the right place to take the next step

If you’re ready to talk through your options or simply want clarity, we’re here to help.

You’re in the right place to take the next step

If you’re ready to talk through your options or simply want clarity, we’re here to help.